A New Chapter for Cyan

Buy-Now-Pay-Later Arrives for NFTs on HyperEVM

In June 2025, the TrueFi community approved TFIP-29, finalizing the acquisition of Cyan, the pioneering NFT lending protocol launched in early 2022. Cyan’s arrival brings a proven credit layer to complement TrueFi’s leadership in real-world asset (RWA) lending. With nearly 25 million dollars in historical loan volume, multiple independent security audits, and innovative features such as Buy Now, Pay Later (BNPL) for NFTs and a smart-contract escrow wallet, Cyan offers battle-tested infrastructure for collateralizing ERC-721 and ERC-1155 assets ranging from digital collectibles to luxury goods.

Cyan Launches Buy-Now-Pay-Later for HyperEVM NFTs

Following the integration into TrueFi, the Cyan team prioritized deployment on Hyperliquid’s HyperEVM, targeting an ecosystem known for its performance, user alignment, and rapid growth. By the end of Q2, Cyan’s core lending and vault infrastructure was live, and strategic incentives in Q3 successfully seeded liquidity and enabled borrowers to access instant NFT-backed loans from day one.

The most significant milestone is now available with the launch of Cyan BNPL on HyperEVM. Users can now acquire Hypurrs and Wealthy Hypio Babies with as little as 25% upfront, paying the balance in fixed monthly instalments while maintaining full custody and utility of the NFT through Cyan’s smart-contract wallet. This unlocks a financing model familiar in traditional markets and elevates it with blockchain-native mechanics, giving HyperEVM collectors a secure and capital-efficient way to access premier digital assets.

By combining Hyperliquid’s strong community alignment with Cyan’s proven credit engine, the integration introduces a powerful new primitive. High-conviction collectors gain flexible access to blue-chip NFTs, while vault depositors earn attractive, risk-adjusted yields backed by some of the most liquid and culturally important assets in the ecosystem.

Why Hyperliquid Was the Clear Choice for Expansion

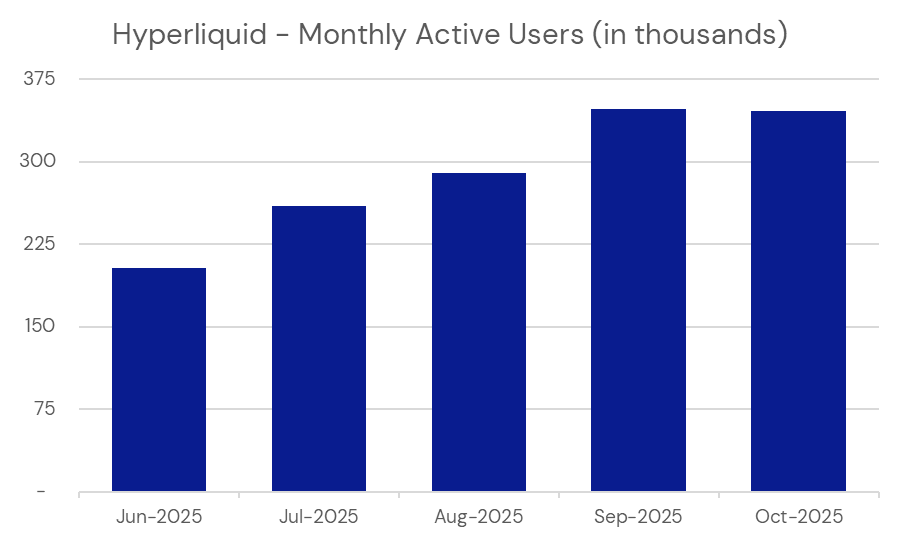

When evaluating ecosystems for Cyan’s next phase of NFT-backed credit protocols, Hyperliquid emerged as the obvious destination. In under two years, Hyperliquid has become the leading decentralized perpetuals platform by open interest and volume, powered by its high-performance L1 and HyperEVM.

The November 2024 Genesis Event delivered the largest airdrop in crypto history, distributing 31% of HYPE supply with a peak value exceeding $8 billion entirely to users and builders, with zero allocations to venture investors. This move created one of the most loyal and high-conviction communities in the industry.

That same community focus is embodied in Hypurr, Hyperliquid’s flagship NFT collection and cultural cornerstone. Distributed free to top contributors and now commanding five-figure floor prices, Hypurr functions as both a status symbol and an access pass to exclusive yield and governance opportunities.

For a credit protocol like Cyan that depends on engaged collateral holders and sustainable vault liquidity, expanding into a chain that has already proven it can align incentives at scale and reward genuine participation was the natural decision. Hyperliquid built not only a fast blockchain but also one of the strongest and most active communities in DeFi today.

Airdropping tokens (or new NFTs like Hypurrs) directly to existing holders acts as a steroid injection into the onchain wealth effect flywheel. It multiplies and accelerates by-products like social classes creation, Risk-seeking feedback loops, Hyper-visible conspicuous consumption, among many other interesting behaviours in onchain economies. Onchain wealth effects create a highly liquid, transparent, global, youth-skewed nouveau riche class that behaves nothing like traditional wealth. Cyan allows for access to liquidity while also retaining the same airdrop benefits and prestige.

Why BNPL a Hypurr?

For most blue-chip NFT collections, buying on instalments carries a painful trade-off: you pay over time, but the asset is locked in escrow and you miss out on its full utility until the loan is repaid. Cyan eliminates that compromise through its unique smart-contract wallet escrow – the same technology that has secured tens of millions in loan volume since 2022.

When a user purchases a Hypurr (or Wealthy Hypio Baby) via Cyan BNPL on HyperEVM, the NFT is immediately transferred into a Cyan-controlled escrow wallet that only the borrower can operate. This means:

The Hypurr remains fully usable in all ecosystem protocols (staking for yield boosts, voting in governance, displaying in metaverse integrations, etc.).

The borrower stays eligible for every ongoing and future airdrop tied to Hypurr ownership – including partner drops from Ramses, RedStone, HyperStone, and potential Season 2 or ecosystem-wide distributions.

The lender is protected: the smart-contract wallet prevents the NFT from being sold or transferred out until the final instalment is paid, giving vault depositors the same security they would have with a traditional pawn.

In practice, this turns a Hypurr BNPL purchase into one of the most capital-efficient moves in DeFi today. A collector can acquire a five-figure asset with 25% down, continue farming every airdrop and yield opportunity the collection offers, and repay the balance from those same rewards – all while the underlying collateral never leaves their control for day-to-day use.

For vault suppliers, the result is equally attractive: high utilization backed by some of the most liquid, culturally significant, and airdrop-generating NFTs in the space. The Cyan wallet makes “have your hype and eat it too” a reality for both borrowers and lenders.

Bringing It All Together

Our expansion into HyperEVM represents a meaningful step forward in how credit markets can operate across digital ecosystems. Hyperliquid has demonstrated what is possible when high-performance infrastructure meets an aligned and highly engaged community. Cyan brings the complementary piece: a secure, transparent, and proven credit layer capable of supporting everything from BNPL for premier NFT collections to broader forms of on-chain asset financing.

Together, these elements create a foundation for scalable and responsible credit growth. Collectors gain capital efficiency without sacrificing ownership or utility. Liquidity providers earn dependable yields backed by culturally significant and actively used assets. Projects across HyperEVM gain a new tool to support demand, engagement, and economic activity.

The launch of BNPL for Hypurrs and Wealthy Hypio Babies is only the first chapter. As Cyan evolves within the TrueFi ecosystem, we expect to expand the types of assets it can support, integrate with more HyperEVM projects, and continue exploring on-chain credit models that bridge digital culture and financial utility.

Cyan was built on the belief that credit is a core primitive for any mature ecosystem. Hyperliquid has built a community that thrives on innovation and ownership. Bringing the two together unlocks new possibilities for both, and we are excited to keep building alongside one of the most forward-thinking communities in crypto today.