Powering the Next Wave of DeFi and On-chain Economic Growth

TrueFi is transforming decentralized finance (DeFi) by enabling asset originators of all sizes to access capital markets, with particular benefits for smaller players, delivering meaningful opportunities for borrowers and lenders. By harnessing its proven vault technology and the composability of blockchains, TrueFi augments traditional credit markets, offering lightning-fast, transparent, and cost-effective lending solutions that will fuel crypto’s expansion.

Uncollateralized Lending: A Catalyst for Economic Growth

At the heart of TrueFi’s mission is its pioneering uncollateralized lending model, a game-changer for the $6 trillion global private credit market. Unlike over-collateralized lending, which ties up capital and stifles efficiency, TrueFi’s approach frees borrowers from collateral lockups, enabling rapid access to funds—often within a single day. The resulting capital efficiency accelerates business growth, allowing asset originators to scale operations, seize opportunities, and drive economic activity faster than traditional or over-collateralized systems. This is particularly helpful for sub-scale borrowers who might be challenged by the frictions of SME lending in traditional markets.

By leveraging proprietary on-chain credit scoring, TrueFi ensures market-driven interest rates and connects borrowers to diverse global liquidity pools, democratizing access to capital once reserved for financial giants. The result? A dynamic ecosystem where innovation thrives, and economic growth outpaces conventional models.

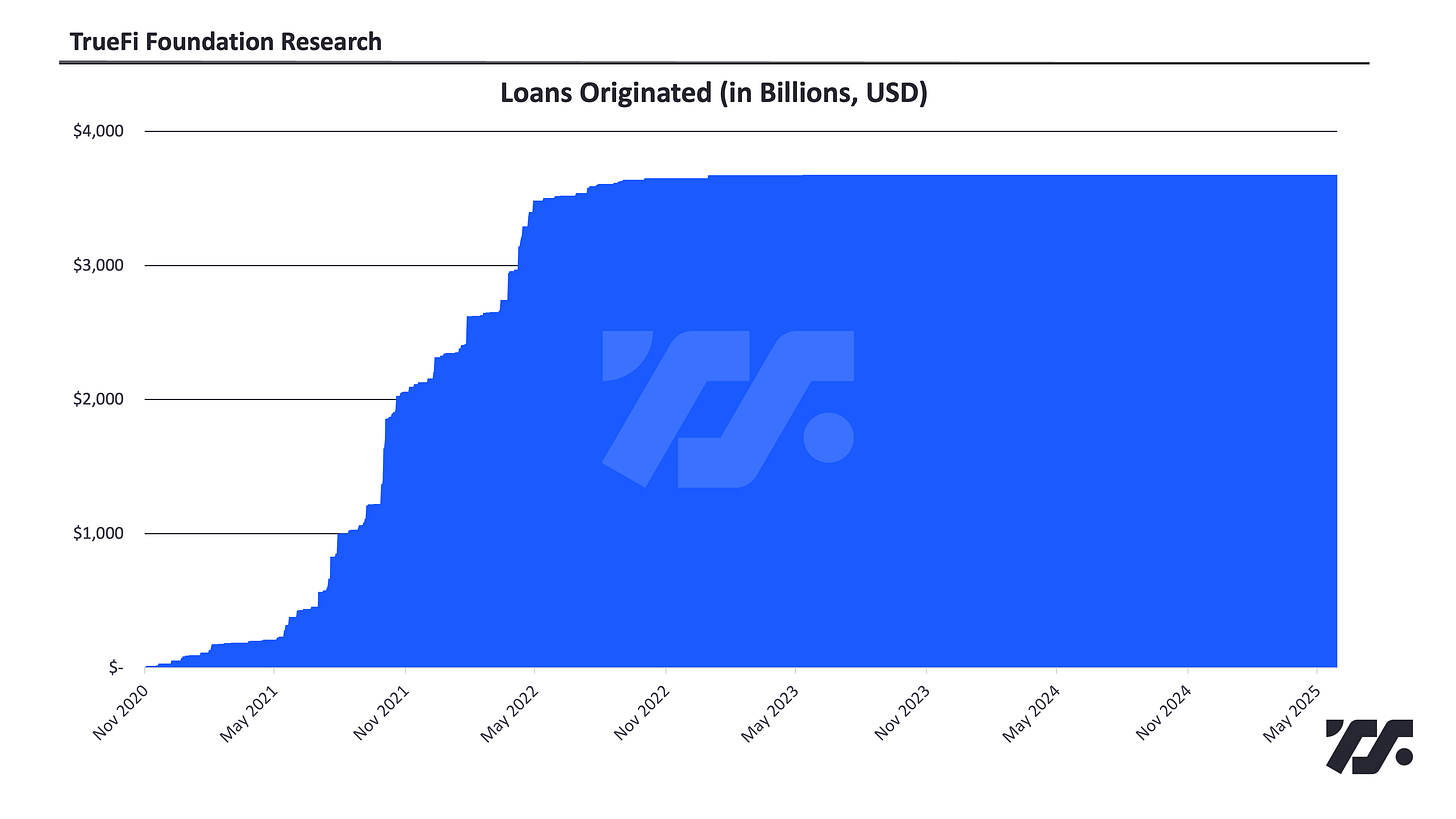

Proven Resilience Through Market Cycles

TrueFi’s lending vaults have shown remarkable resilience, navigating the volatility of crypto markets since the platform’s inception in 2020. With over $1.5 billion in uncollateralized loans facilitated, TrueFi’s robust credit scoring and risk management systems have maintained operational integrity, with no recorded exploits compromising its vault infrastructure. Despite facing credit losses during the 2022 market downturn, the platform’s transparent on-chain architecture and TRU token staking mechanisms preserved lender confidence. Hardened by these challenges, TrueFi’s ongoing turnaround initiatives—including a user-friendly front-end redesign and innovative offerings like the Elara stablecoin—are poised to strengthen the platform, enhancing accessibility and performance for all users.

Turnaround Initiatives: A Bold Vision for the Future

TrueFi is in the midst of an ambitious turnaround, rolling out transformative initiatives to cement its leadership in DeFi. Key developments include:

Elara: Yield-Bearing Stablecoin: TrueFi is launching Elara, a yield-bearing stablecoin designed to offer stable, regulatory-compliant returns for holders, bridging the gap between traditional finance and DeFi. Elara aims to provide investors with a low-risk, high-reward asset that integrates seamlessly with TrueFi’s lending pools.

Front-End Reskinning: A sleek, user-friendly front-end overhaul is underway, enhancing accessibility and usability for both retail and institutional users. This redesign will streamline onboarding and portfolio management, making TrueFi’s platform more intuitive than ever.

New Business Development Initiatives: TrueFi is forging partnerships to bring compliant, high-yield opportunities to lenders, including innovative lending pools with yields up to 20% for market makers and payment service providers. Collaborations with firms like Cicada and Akemona are expanding TrueFi’s real-world asset (RWA) offerings, attracting global investors.

A Glimpse at Cyan: TrueFi recently acquired Cyan, an NFT platform, signaling its expansion into new DeFi frontiers. Stay tuned for more details on how this deal will unlock novel opportunities for TrueFi’s ecosystem.

These initiatives position TrueFi to capture growing demand for decentralized, compliant financial solutions, aligning with the broader DeFi market’s projected growth to $232 billion by 2030.

Empowering Small Asset Originators

TrueFi’s infrastructure levels the playing field for small asset originators, enabling them to launch investment strategies and tap global liquidity from day one. By bringing alternative investments on-chain, TrueFi eliminates traditional barriers, such as high operational costs and gatekeeping by large institutions. Smart contract automation streamlines fund administration, reporting, and compliance, allowing smaller players to scale efficiently in a decentralized, global market.

Unlocking High-Yield Opportunities for Lenders

Lenders on TrueFi will soon enjoy access to a diverse array of crypto-native and real-world asset-backed loans, with some of DeFi’s most competitive yields. The platform’s transparent, on-chain architecture provides real-time visibility into capital flows, fostering trust and accountability unmatched by traditional private credit markets. TRU token staking and robust encryption protocols further protect lenders, ensuring sustainable returns even in volatile markets.

Pioneering the Future of Finance

TrueFi’s vision extends far beyond DeFi, aiming to transform the global credit market by bridging traditional and decentralized finance. With innovations like tokenized real-world assets (e.g., U.S. Treasury bill tokens) and plans for international RWA expansion, TrueFi is redefining financial accessibility. By addressing structural inefficiencies and embracing blockchain’s potential, TrueFi is building a transparent, inclusive financial ecosystem where institutional and retail participants can thrive.

Join TrueFi today and be part of the DeFi revolution—where capital flows freely, opportunities abound, and the future of finance is now.