Reintroducing TrueFi

The Past, the Pivot, and What Comes Next

Since its launch in late 2020, TrueFi has stood at the frontier of one of DeFi's boldest experiments: unsecured, on-chain lending.

Born out of the TrustToken ecosystem, the protocol set out to solve a core limitation of blockchain finance—how to assess creditworthiness and enable access to capital without relying on overcollateralization. Backed by over $31 million in early-stage funding, TrueFi launched with a clear mission: use smart contracts, community governance, and hybrid credit models to bring both real-world and crypto-native borrowers on-chain.

What We Built

Over its initial phases, TrueFi pioneered several firsts that helped expand the boundaries of decentralized credit:

KYC-enabled institutional lending pools that bridged TradFi compliance with DeFi efficiency

Uncollateralized loans backed by enforceable legal agreements

Liquid exit mechanisms offering lenders capital flexibility

On-chain governance powered by the TRU token, enabling community-directed evolution

By mid-2021, TrueFi had originated hundreds of millions in loans across USDC, TUSD, and USDT, validating the idea that creditworthiness could exist on-chain, without collateral.

The Crucible

The 2022–2023 cycle tested not just TrueFi, but the entire thesis of DeFi credit. What began as a bull-market experiment was thrown into its first true stress test—a crucible forged by some of the harshest conditions in crypto's history.

A convergence of systemic risks created the perfect storm:

Macro headwinds: Rising interest rates made risk-on DeFi yields less attractive compared to traditional finance, while broader crypto deleveraging drained capital from the ecosystem.

Systemic contagion: The collapse of Terra/Luna, followed by the unraveling of 3AC, Celsius, and FTX, triggered a cascade of defaults that revealed just how deeply interconnected crypto credit markets had become.

Regulatory uncertainty: Heightened global scrutiny introduced significant ambiguity around the legal status and compliance obligations of DeFi lending protocols, especially those interfacing with real-world assets.

Underdeveloped risk frameworks: First-generation credit models often relied on reputation and social capital, rather than rigorous underwriting, leaving protocols exposed when the market turned.

TrueFi was not immune. Borrower defaults and liquidity pressures tested the protocol's recovery mechanisms, legal architecture, and governance processes. It was a period that forced difficult but necessary conversations around risk concentration, portfolio diversification, and the very foundations of on-chain credit infrastructure.

Yet these moments of stress were also moments of clarity. The crucible of 2022–2023 revealed:

The importance of transparent, sound underwriting frameworks, throughout the cycle

The need for diversified borrower sets spanning sectors, geographies, and use cases

The value of enforceable legal agreements alongside on-chain execution

The limits of token-based or socially-driven credit scoring

The resilience of well-structured lending pools with built-in risk controls

Critically, the cycle proved that while some DeFi lending models failed, the core promise of on-chain credit endured. Protocols that applied sound underwriting, maintained governance discipline, treasury management, and built for resilience—not just returns—survived.

For TrueFi, these hard-won lessons didn't diminish our ambition, they refined it. The next generation of DeFi credit won't be built on bull-market exuberance, but on the tempered, tested insights of a full market cycle.

The Evolution

Today, TrueFi is undergoing a thoughtful transformation.

We're evolving from a lending protocol into a modular credit infrastructure layer—one designed to support permissionless capital formation with:

Transparent, composable underwriting tools for diverse lending strategies

A curated borrower whitelist with verifiable on-chain credit histories

Smart contract rails for uncollateralized and real-world lending

Governance frameworks that enable decentralized risk oversight without falling into the traps of discretionary asset management

A critical component of this evolution is the incubation of Elara Finance—a next-generation yield-bearing stablecoin protocol soon to launch. Elara addresses a fundamental limitation of traditional stablecoins: their inability to generate returns on underlying collateral. By sustainably distributing yield while maintaining a stable peg, Elara offers a compelling alternative for institutions and individuals holding stablecoins for payments, remittances, or treasury management.

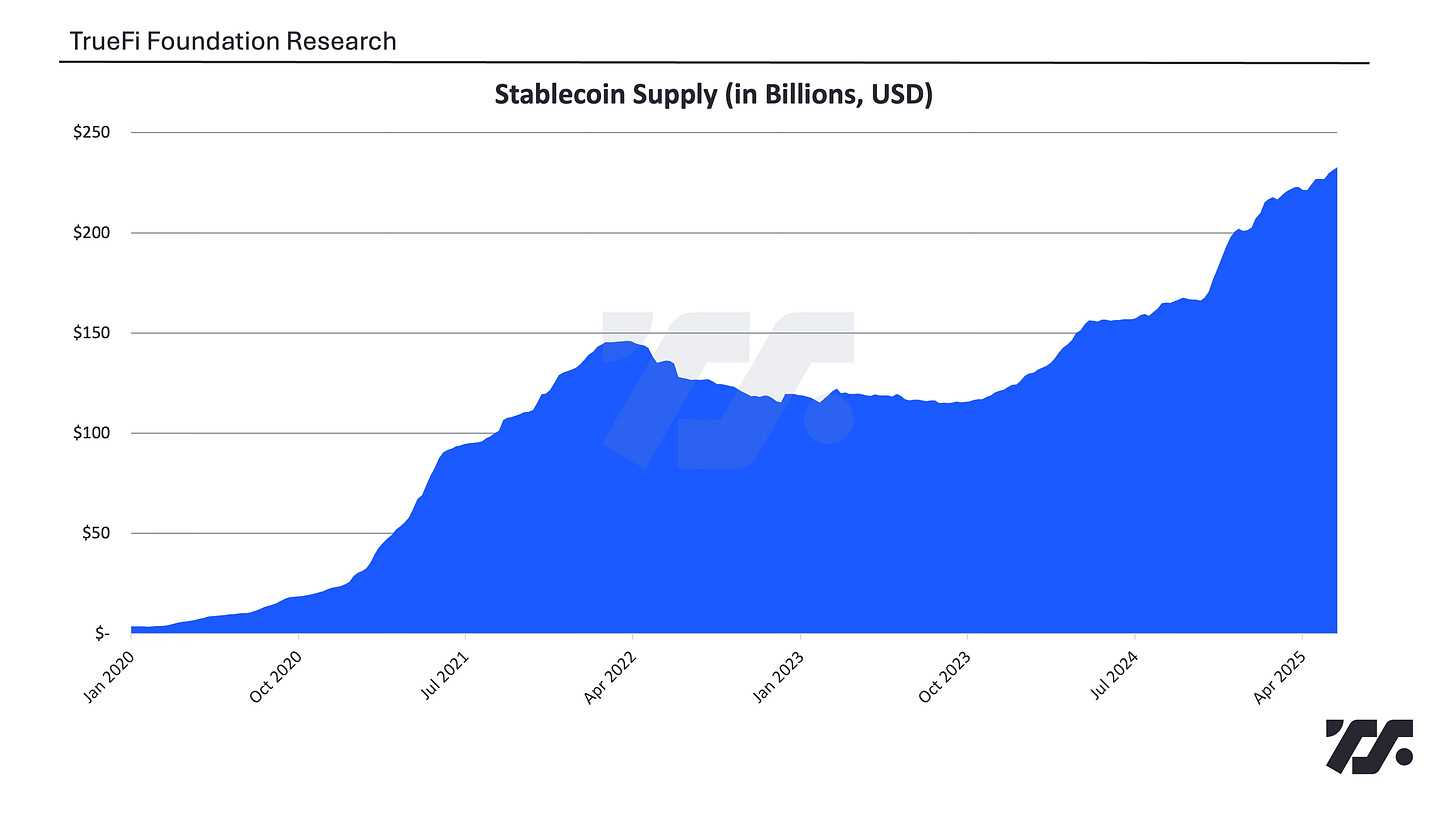

The protocol intelligently deploys deposits into blue-chip, low-risk yield strategies, distributing returns to both holders and stakers, with yield amplification for those who commit capital for longer periods. With initial launch details to be released in the coming weeks, Elara aims to establish itself as a leading stable asset in the growing $250 billion stablecoin market.

This symbiotic relationship between TrueFi and Elara represents our holistic vision for on-chain credit infrastructure—where lending rails and yield-bearing stablecoins create a more efficient capital stack for the entire ecosystem.

This evolution is not a tactical pivot—it's a foundational realignment that directly addresses the vulnerabilities exposed during the market downturn while building on the elements that proved resilient. We believe DeFi will scale not by mimicking hedge funds with tokens, but by building public infrastructure: the credit rails, standards, and tooling to support the next generation of decentralized finance.

What Comes Next

Over the coming weeks, we'll be rolling out a new wave of content focused on this next chapter. Topics will include:

How protocol-to-protocol lending unlocks a new capital stack for crypto

What survived the 2022 collapse—and why it matters

The blueprint for a decentralized underwriting system

What DeFi vaults can learn from money market funds to attract institutional capital

The role of stablecoins, privacy, and modular governance in the future of on-chain credit

This content strategy builds on TrueFi's recent momentum. In the past quarter alone, we've seen the successful deployment of our updated protocol architecture, onboarded new institutional borrowers, and maintained 100% repayment rates across active loans—demonstrating that our refined approach to credit infrastructure is gaining traction even in challenging market conditions.

Building With You

Whether you're an LP seeking sustainable yield, a borrower in need of efficient capital, a DAO exploring treasury options, or simply curious about where DeFi credit goes next—we're building with you in mind.

TrueFi's journey reflects the broader evolution of DeFi: from experimentation to resilience, from standalone protocols to shared infrastructure. We believe the future of finance is being built on-chain—and that credit is its cornerstone.

Thanks for being part of the journey. The best is yet to come.