TrueFi DAO Supports Hypurr NFT Lending on Cyan

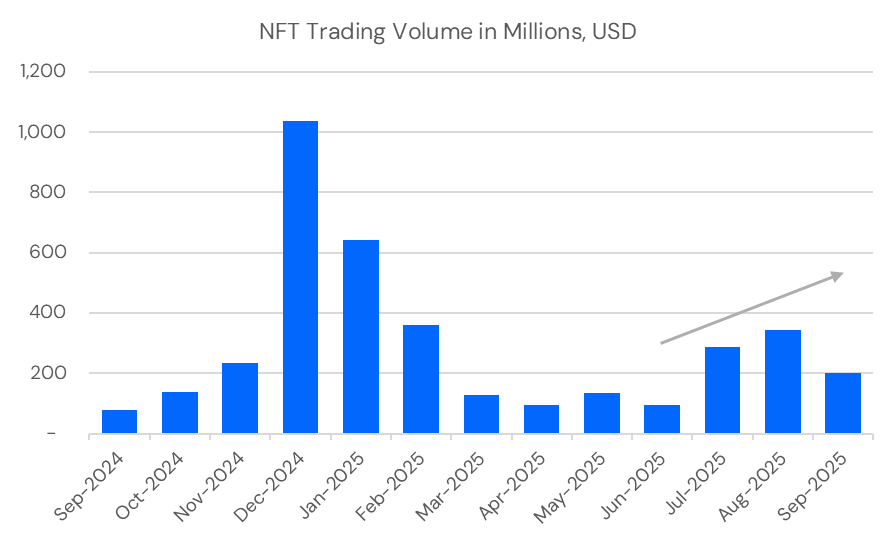

The world of digital assets is full of experimentation, and few areas have captured as much imagination as non-fungible tokens. NFTs first exploded into mainstream awareness in the last cycle. They became cultural artifacts, works of digital art, and identity markers that spread across online communities. At their peak, NFT markets moved billions of dollars and filled headlines across financial and cultural media alike. While the speculative frenzy cooled, NFTs never disappeared. They remain an integral part of the crypto ecosystem, continuing to evolve and proving their resilience over time.

For many, NFTs are not just digital items. They are a way to show belonging to a community, to display taste and values, and to participate in something that feels collective and alive. Whether it is an artist’s unique work, a profile picture that signals tribe, or a membership pass to a digital collective, NFTs have cemented their place as ongoing expressions of culture and identity on-chain.

From Collectibles to Financial Assets

The story of NFTs cannot be understood purely through the lens of art or cultural value. They are also financial assets. NFTs represent ownership rights that are secured on blockchains and can be traded, valued, and used as collateral. For many participants, the NFTs they hold are both cultural and financial. That dual identity is powerful because it allows holders to stay connected to their communities while also recognizing the real-world value of their assets.

This is where Cyan becomes so important. Access to liquidity is a foundational pillar of any financial system. Token holders have long been able to borrow against fungible assets, such as ETH or stablecoins. NFT holders deserve the same opportunity. By unlocking liquidity against NFTs, users can remain part of the communities they value while also putting their capital to work. Whether that means deploying funds into new investments, managing cash flow, or compounding trading strategies, the ability to borrow without selling has been a transformative tool across all asset classes. NFTs should be no exception.

The Hyperliquid and Hypurr Story

One of the ecosystems that stands out in this next chapter for NFTs is Hyperliquid. Built with a grassroots spirit, Hyperliquid has quickly become a home for a new wave of community-driven experimentation. The Hypurr NFT collection emerged as a thank-you to the earliest believers in Hyperliquid. It embodies the same ethos of participation and shared growth that has defined the platform.

The Hypurr NFTs are more than images. They carry symbolism for being early to one of the fastest growing crypto ecosystems and they are traded with enthusiasm as status symbols and as potential conduits to future utility. The collection reflects the broader energy around Hyperliquid: fast-moving, community-centric, and deeply aligned with the ethos of building together.

At TrueFi, we value Hyperliquid because it represents many of the qualities that drive long-term success in crypto. Innovation is matched with a focus on users. Growth comes not through top-down campaigns but through the passion of community members. This alignment with our own values makes Hyperliquid a natural partner for TrueFi as we expand into new frontiers of on-chain credit.

TrueFi and Cyan

To understand how this initiative comes together, it is worth revisiting TrueFi’s acquisition of Cyan. Cyan is an NFT lending platform designed to make credit markets for NFTs more secure, transparent, and composable. It allows holders to pledge NFTs as collateral, borrowers to unlock liquidity, and lenders to access new yield opportunities. By merging Cyan into TrueFi’s broader infrastructure, we are ensuring that NFT credit can exist alongside other forms of lending.

Cyan’s design reflects our belief that all digital assets, whether fungible or non-fungible, deserve to be part of the same credit ecosystem. NFTs are no longer a separate corner of the market. They are deeply intertwined with the rest of crypto, and lending against them should be held to the same standards of efficiency, transparency, and institutional readiness that TrueFi applies elsewhere.

A Hypurr-fect Combination

Today we are excited to announce that the TrueFi DAO will deploy a portion of its treasury to bootstrap liquidity for Hypurr NFT lending on Cyan. This deployment will create immediate capacity for NFT holders in the Hyperliquid ecosystem to borrow against their Hypurr collections.

The goal is simple. By providing initial liquidity, we lower the barriers for holders to access credit markets and encourage broader participation. We see this as a way to support the Hyperliquid community directly, to validate the role of NFTs in credit markets, and to showcase what can be built when DeFi and NFT ecosystems collaborate.

Liquidity is the lifeblood of financial systems. In the absence of early capital, markets can stall before they have a chance to prove themselves. By deploying DAO treasury resources, TrueFi is not only supporting NFT holders but also signaling confidence in the long-term potential of NFT lending.

Strategic Importance

This initiative is not a side project. It is a natural extension of TrueFi’s mission. Our goal has always been to expand access to credit across digital assets, building the infrastructure required for institutional-scale adoption of on-chain finance. NFTs belong in that picture.

By enabling lending against NFTs, we are broadening the scope of assets that can interact with on-chain credit. We are showing that tokens of community and culture can also serve as reliable financial instruments when supported by thoughtful design and adequate liquidity. Both fungible tokens and NFTs deserve to live in the same system, governed by transparency and accessible to users everywhere.

The collaboration between TrueFi, Cyan, and Hyperliquid is also an example of how decentralized ecosystems can align. Each brings unique strengths: TrueFi with its credit infrastructure, Cyan with its NFT lending specialization, and Hyperliquid with its community-first momentum. Together, these strengths create a platform for innovation that could have ripple effects well beyond one collection.

Looking Ahead

Hyperliquid and the Hypurr collection represent the kind of grassroots innovation that keeps the industry moving forward. By providing treasury capital to bootstrap liquidity on Cyan, TrueFi is helping ensure that NFT holders can access secure and transparent credit markets without leaving the communities they value. Pretty soon, you’ll be able to tap into Cyan’s Buy now, pay later offering on Hyperliquid too.

We believe this effort will not only benefit Hypurr NFT holders today but also demonstrate a pathway for other NFT-driven communities on Hyperliquid in the future. When NFTs and DeFi come together, they create systems that are both financially functional and culturally expressive.

The TrueFi DAO is proud to play a role in shaping this future. We invite lenders, borrowers, builders, and community members to join us in building credit markets that are open, resilient, and aligned with the ethos of crypto.

We look forward to building that future with you.