Unlocking the Next Frontier

NFT Lending and the Future of On-Chain Credit

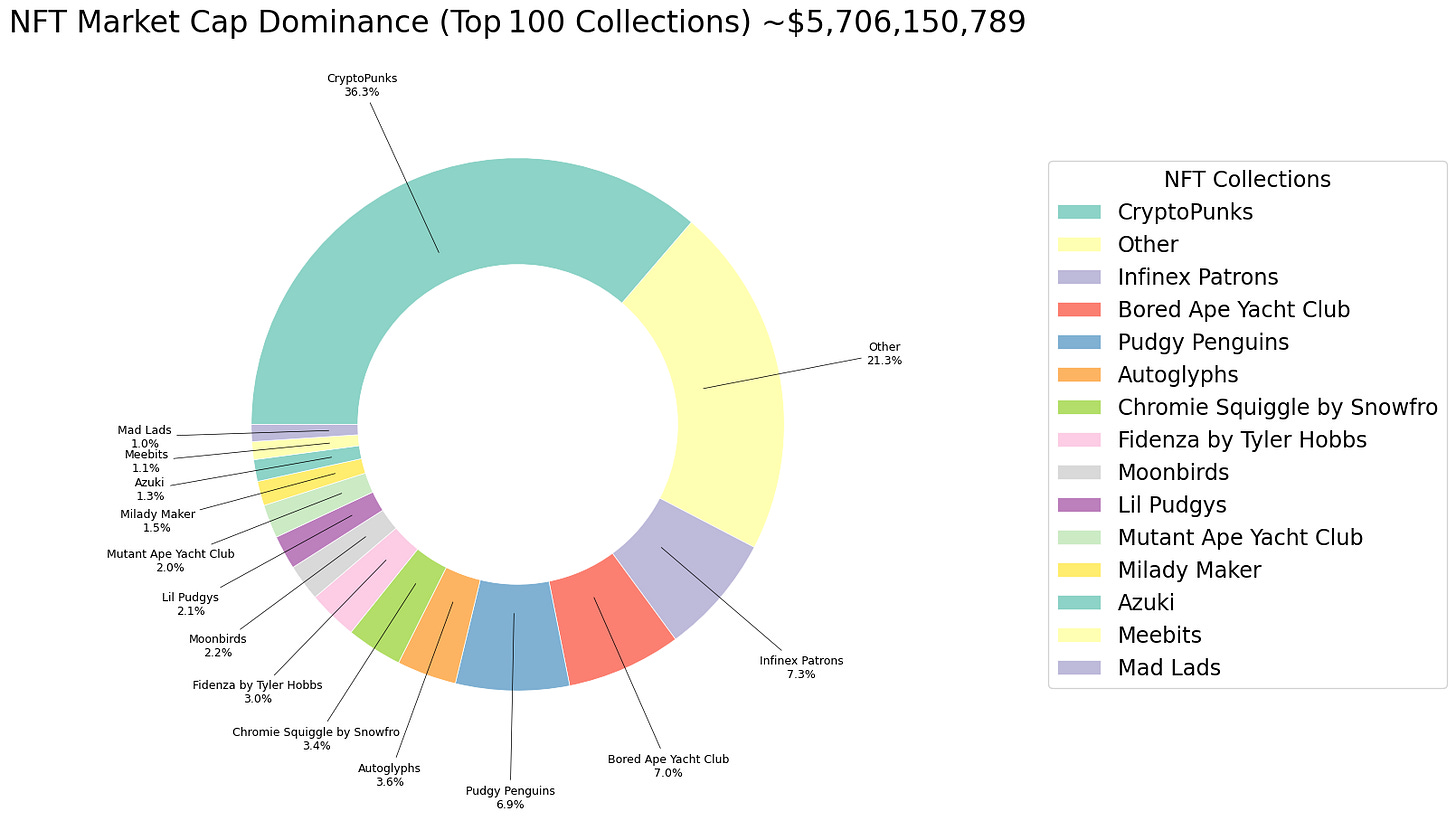

Non-fungible tokens (NFTs) have already transformed how digital wealth is expressed and traded. From profile pictures to in-game assets to tokenized art, NFTs are the most visible marker of identity and ownership in crypto. But their role is rapidly expanding beyond collecting and signaling status. Crypto loves to financialize and NFT lending has emerged, merging credit markets with the world of digital ownership. This post explores what NFT lending is, why it matters today, and how it could shape the future of both decentralized finance (DeFi) and traditional credit markets.

What Is NFT Lending?

At its core, NFT lending allows holders of NFTs to use their assets as collateral for loans. The process looks like this:

Collateralization – A borrower deposits an NFT into a lending protocol.

Valuation – The protocol or marketplace determines the collateral’s value, often using floor prices, oracle feeds, or negotiated terms.

Loan Issuance – A lender provides capital, often in stablecoins, against the collateral.

Repayment or Liquidation – If the borrower repays with interest, they reclaim their NFT. If not, the lender may seize and liquidate it.

This structure mirrors traditional secured lending, where a house secures a mortgage or a car backs an auto loan. The difference is that NFTs are digitally native and verifiably scarce, enabling fully on-chain execution.

Why NFT Lending Is Exciting Today

On-Chain Wealth Wants to Show Off

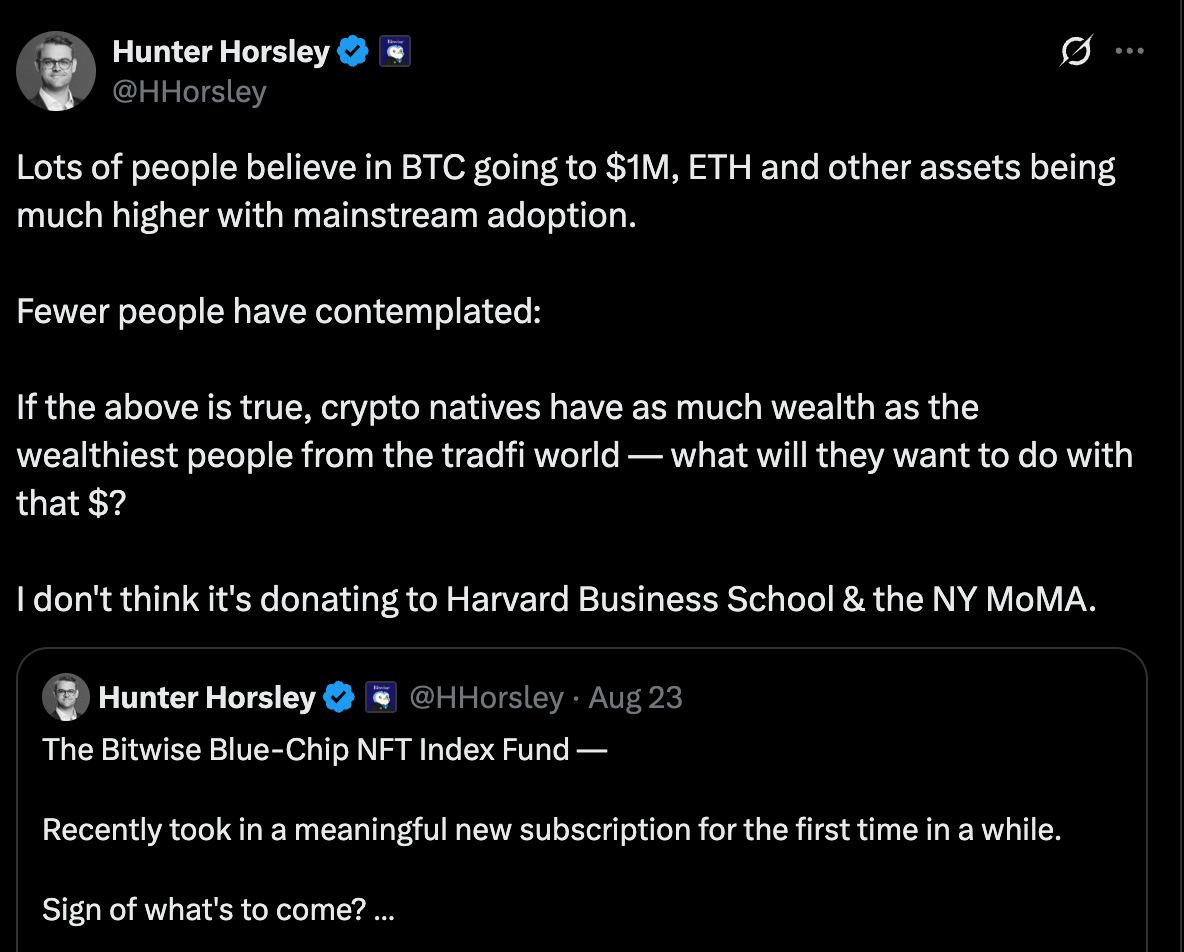

Crypto is not just about financial returns; it is also about identity and community. NFTs have become one of the best ways to signal digital wealth and taste. Just as luxury watches or rare cars serve as status symbols in the physical world, blue-chip NFTs like CryptoPunks or Pudgy Penguins serve the same role online. NFT lending allows these holders to unlock liquidity without selling their prized assets, keeping the flex while putting dormant capital to work.

NFTs as Collateral

Unlike governance tokens or fungible assets, NFTs are unique and non-interchangeable. That uniqueness makes them excellent collateral in many cases: they are scarce, tradable, and verifiably owned. For lenders, this opens an entirely new class of assets to underwrite. For borrowers, it means unlocking liquidity against holdings that might otherwise sit idle.

Attractive Yields

Yields in NFT lending markets can be substantial. Because liquidity is thinner and volatility higher than in fungible token markets, lenders are often compensated with higher interest rates. Borrowers may find this worthwhile because it saves them from liquidating NFTs they believe will appreciate in value or that carry social capital too valuable to give up.

NFT Lending in the Broader Digital Asset Landscape

NFT lending does not exist in isolation. It fits neatly into broader trends reshaping finance:

Tokenization of Real-World Assets (RWAs): Increasingly, real-world ownership from real estate to bonds is expected to take the form of NFTs. These tokens can function like bearer securities in traditional finance, where physical possession equates to ownership. On-chain, this means whoever holds the token has a verifiable claim to the underlying asset.

Credit Market Expansion: Just as bearer securities once made capital markets more flexible, NFT-based ownership models will make digital lending more seamless. The logic is simple: if you can own it as an NFT, you should be able to borrow against it.

Natural Fit for Lending Platforms: Lending thrives where there is collateral that is both valuable and transferable. NFTs fit this model perfectly, creating a clear bridge between digital identity, real-world assets, and DeFi credit rails.

This evolution strengthens the case for platforms like TrueFi, which already focus on transparent, on-chain credit. NFT lending is not a tangent. It is an extension of the same mission: creating a capital market where any verifiable asset can support credit.

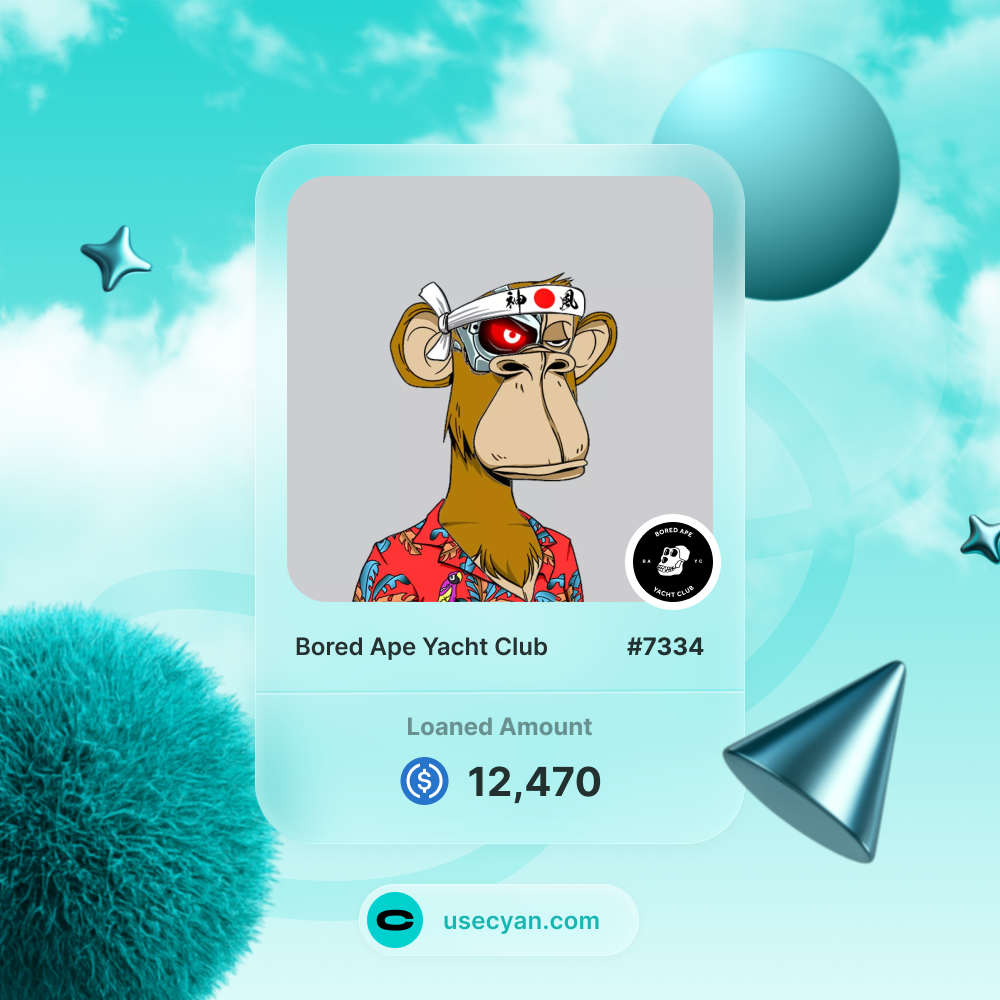

Spotlight: Cyan and the HyperEVM Advantage

One of the most exciting projects in this space is Cyan (usecyan.com), which recently became part of the TrueFi ecosystem. Cyan is an NFT lending protocol built by an exceptional team with deep technical and financial expertise.

Cyan has already made waves as one of the first projects to launch on HyperEVM, the programmable layer within the Hyperliquid ecosystem. HyperEVM offers low-latency execution and an environment designed for composable financial applications. By deploying early here, Cyan positions itself not only as an NFT lending pioneer but also as a cornerstone of one of the most innovative on-chain platforms emerging today.

This is significant for two reasons:

First-Mover Advantage: Being early in a new ecosystem means Cyan can define the standards and user experience for NFT lending on HyperEVM.

Strategic Fit: By combining NFT collateral markets with Hyperliquid’s high-performance infrastructure, Cyan can offer lending that is faster, more reliable, and more accessible than ever before.

For TrueFi, integrating Cyan strengthens our broader vision: building a multi-faceted credit marketplace where every valuable asset, whether fungible tokens, RWAs, or NFTs, can be put to productive use.

Why NFT Lending Matters for the Future of Finance

NFT lending represents more than just another niche in DeFi. It points toward a financial system where:

Assets Are Fluid: Whether an asset is digital art, an in-game skin, a real estate deed, or a yield-bearing security, its ownership and collateral value can be recognized on-chain.

Identity and Finance Converge: Digital identity, expressed through NFTs, merges with financial activity. Your wallet does not just show what you own; it underpins what you can borrow.

Credit Becomes Universal: By broadening the types of assets that can secure loans, credit becomes accessible to more participants, with more tailored products.

The analogy to bearer securities is useful here. In traditional finance, bearer bonds or certificates allowed for anonymous, transferable claims on capital. NFT-based ownership could reintroduce that flexibility, only now with the transparency, programmability, and security of blockchain technology.

A Natural Extension of On-Chain Credit

The rise of NFT lending underscores the adaptability and creativity of decentralized finance. It takes what was once seen purely as a cultural or speculative phenomenon and channels it into productive financial infrastructure.

For NFT holders, this means new liquidity. For lenders, it means new opportunities for yield. For DeFi as a whole, it means a step toward markets where any asset, digital or real, can support credit activity.

At TrueFi, we see NFT lending as a natural complement to our core business. Our mission has always been to expand access to transparent, permissionless credit. With Cyan’s integration and early move on HyperEVM and existing capabilities on Ethereum, NFT lending is no longer a thought experiment. It is here, and we anticipate it will grow fast.

The future of finance treats art, identity, real-world assets, and capital markets as part of a programmable, on-chain economy. NFT lending is one of the first clear steps in that direction, and we are excited to help lead the way.