Unlocking Trillions From Credit Markets Through Blockchain Innovation

The Untapped Opportunity

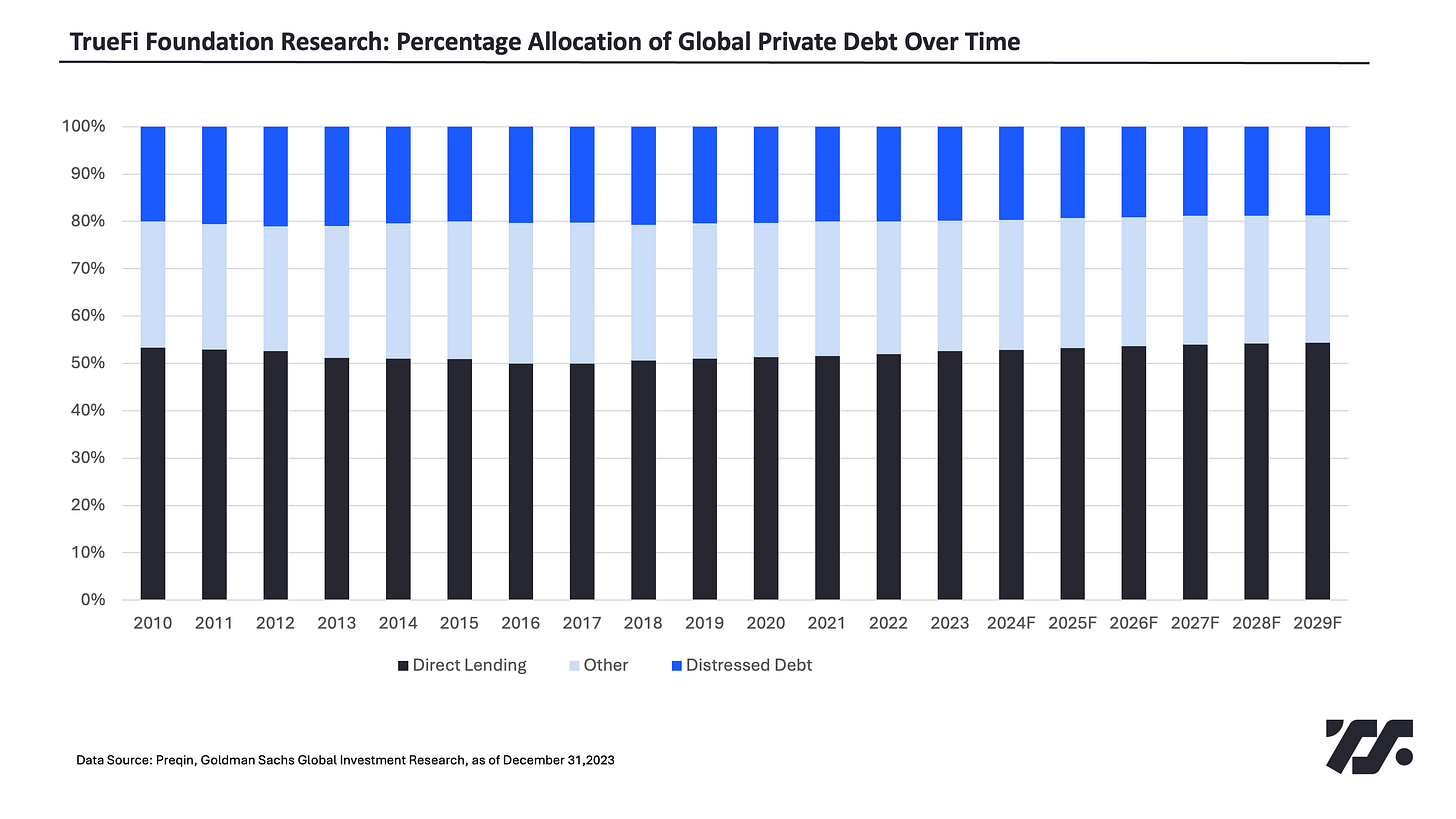

Private credit—now greater than $6 trillion globally—is one of the fastest-growing segments in finance. As banks retreat from certain forms of lending and institutional appetite for yield grows, non-bank credit has surged. Yet despite this growth, the market remains largely opaque, illiquid, and difficult to access. Hence, it’s dominated by a handful of large players and manual, relationship-driven processes.

Meanwhile, most DeFi lending protocols remain confined to overcollateralized, crypto-native models, rendering them incapable of serving real-world businesses that need working capital, stablecoin liquidity, or more flexible credit terms.

TrueFi is purpose-built to address this gap. By fusing blockchain infrastructure with principles of institutional credit, TrueFi delivers a transparent, efficient, and programmable platform for uncollateralized lending—paving the way for a new form of open, on-chain private credit. The flexiblity of smart contract infrastructure allows TrueFi to service debt across consistently growing global demand for credit yields, b

Beyond Overcollateralization: TrueFi’s Core Innovation

Unlike leading DeFi platforms such as Morpho and Aave (which require borrowers to lock up significantly more in collateral than they borrow) TrueFi enables fully uncollateralized loans through third-party credit assessments and legally binding agreements.

This fundamental shift solves DeFi’s capital efficiency problem while unlocking lending opportunities for traditional businesses that don’t hold crypto but would benefit from access to on-chain stablecoin liquidity.

Proven Market Traction

Since launching in November 2020, TrueFi has demonstrated real-world execution:

Nearly $2 billion in uncollateralized loans originated

Approximately $40 million distributed to lenders

These metrics validate TrueFi’s thesis: blockchain can support sophisticated credit decisions, improving both efficiency and scale in capital markets.

Bridging Traditional Finance and DeFi

TrueFi accelerat3ed adoption of crypto and RWAs by forming strategic partnerships that connect traditional finance to decentralized infrastructure:

Adapt3r Digital: Launched tokenized portfolios offering on-chain access to U.S. Treasury yields—bringing the stability of government securities to DeFi-native investors.

Cicada Partners: Introduced third-party risk assessments and legal structuring tailored to businesses seeking stablecoin financing, aligning blockchain lending with traditional compliance standards.

These partnerships showcase TrueFi’s broader vision: to serve real financial needs across both crypto-native and off-chain economies.

At the same time, we’re investing in building in-house credit and structuring capabilities—enabling us to underwrite, service, and support more complex lending relationships natively on-chain. By combining strategic partnerships with internal development, TrueFi is laying the foundation for a more vertically integrated and resilient credit protocol—capable of supporting institutional borrowers, innovative credit products, and evolving market needs.

Reimagining Credit Infrastructure

TrueFi’s flexible credit lines echo traditional Revolving Lines of Credit (RLOCs), but with three key advantages:

Radical Transparency: All loan activity is recorded on-chain, offering lenders full visibility into capital allocation and borrower behavior—something rarely seen in TradFi.

Democratized Access: Direct lending, once reserved for large institutions, becomes accessible to a wider range of participants. This has the potential of unlocking higher returns for LPs while reducing costs for borrowers.

Programmable Compliance: Smart contracts enforce loan terms automatically, reducing counterparty risk while ensuring regulatory alignment.

The Path Forward

As traditional finance continues to integrate blockchain technology, TrueFi is emerging as a benchmark for automated, market-driven lending infrastructure. By addressing structural inefficiencies in both TradFi and early-stage DeFi, TrueFi is building the credit rails needed to scale uncollateralized lending globally.

Still early in its journey, TrueFi represents one of the most credible and scalable approaches to bringing the $8 trillion global credit market on-chain—transforming how capital flows to businesses, and creating new opportunities for investors, DAOs, and protocols alike.